Man Utd bosses meet in Switzerland amid talk of Saudi takeover

NewsSaturday, 11 October 2025 at 18:20

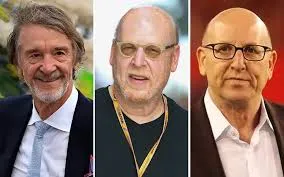

Manchester United’s powerbrokers gathered in Switzerland this week for one of their regular executive committee (ExCo) meetings — a monthly summit led by Sir Jim Ratcliffe, alongside at least one of Joel or Avram Glazer, senior INEOS figures, and chief executive Omar Berrada.

Morale had improved slightly following last weekend’s Premier League win over Sunderland, easing some of the mounting pressure on Rúben Amorim.

Yet, within Old Trafford’s corridors of power, there remains a keen awareness of the restless mood among supporters.

Read also

And as ever with United, calm never lasts long.

On Wednesday, Ratcliffe made his first substantial public comments about Amorim’s future since March, declaring that the head coach had “three years” to prove himself.

Hours later, a social media post from Turki Al-Sheikh — a senior Saudi Arabian official and sports promoter — sent the football world into a frenzy. His claim that United were “close to being sold” sparked 48 hours of feverish speculation, although the club has stayed silent.

Ownership Structure

United’s ownership remains a complex web. The club’s Class A and Class B shares divide control between public investors and the Glazer family, who retain nearly 68 per cent of voting rights despite owning under half of total shares.

Ratcliffe’s INEOS group holds just under 29 per cent of each share class after investing $300 million in 2024 — a deal that handed him control over football operations and significant sway in the club’s business affairs.

Read also

The Saudi Speculation

Al-Sheikh’s influence in Saudi sports, particularly through Riyadh Season, gave his comments extra weight. Although he later clarified that he was not personally involved in any deal — nor was the potential investor from Saudi Arabia — his post had already been viewed nearly six million times, igniting global chatter about a potential takeover.

What Comes Next

A possible sale remains complicated. The “drag-along rights” clause in Ratcliffe’s agreement allows the Glazers to compel his participation in a full sale before February 2027, provided the share price exceeds $33 — the rate Ratcliffe paid.

That means any buyer before that date would face a minimum valuation of around $5.7 billion (£4.3bn), potentially making United the most expensive club ever sold.

After that clause expires, however, the Glazers could sell for less — a scenario that may explain renewed talk of outside investors.

For now, speculation reigns once again at Old Trafford — proof that in Manchester United’s world, stability is always fleeting.

Loading