Glazers first bizarre moves at Man Utd as they brought the club to its knees

NewsSunday, 23 March 2025 at 17:32

When Joel, Avram, and Bryan Glazer, three of the Glazer siblings, first stepped onto British soil as Manchester United’s new owners on June 27, 2005, their initial stop after landing in London was a notable one. Fresh from Heathrow, they headed straight to Vodafone’s headquarters in Newbury, Berkshire, signaling their immediate priorities.

For some, this visit topped their agenda—a direct trip from the airport to meet with the telecom titan, which was growing anxious about its £9.5 million-a-year shirt sponsorship with the Premier League’s most decorated club.

The £790 million leveraged buyout of United by the Glazers had sparked outrage among supporters, and Vodafone found itself in the crosshairs of fan groups furious over the takeover. The siblings were there to sit down with Peter Bamford, Vodafone’s chief executive, though no one at United knew quite what to expect from the trio.

Read also

Many anticipated a charm offensive—perhaps some American-style flattery aimed at reassuring a corporate giant that dwarfed United in revenue, if not in fame.

Since the 2001-02 season, Vodafone’s logo had adorned United’s kits, becoming a symbol of triumphs tied to stars like David Beckham—who had since moved on—as well as Roy Keane, Ryan Giggs, and emerging talents Cristiano Ronaldo and Wayne Rooney. It was the richest shirt deal in football at the time.

But the Glazers didn’t follow the expected script. “They came across as dismissive with Vodafone,” a source close to the situation told Telegraph Sport. “Their stance was, ‘We’re going to take this club to new heights.’

They exuded confidence—bordering on arrogance.” That approach backfired when Vodafone pulled out in August, invoking a contract clause tied to the change in ownership. Yet the Glazers turned that setback into a triumph, securing a more lucrative successor deal. While their knack for commercial wins shone through, their grip on the club’s footballing side would prove far shakier.

Read also

That first encounter, barely a month into their reign, offered an early glimpse into the enigmatic, reserved family now steering Old Trafford.

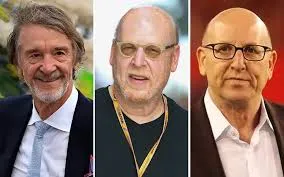

These three middle-aged, balding American businessmen, often seen in glasses, baffled United’s top brass. David Gill, the club’s chief executive, was used to dealing with commanding figures like Sir Alex Ferguson—larger-than-life characters in a 2005 English football landscape where owners, aside from the extravagantly wealthy Roman Abramovich, were mostly British, brash, and from varied business backgrounds.

The Glazers didn’t fit that mold. For nine months, United’s board had battled a takeover bid from a family they barely understood, armed with a debt-heavy plan they despised. Fans, meanwhile, loathed the Glazers from day one for saddling a debt-free club with massive loans.

Earlier that year, in February, Joel, Avram, and Bryan had visited London to pitch their vision to a wary board. Mark Rawlinson, then a takeover specialist at Freshfields and a lifelong United supporter—whose grandfather once played for the club’s reserves—was present.

Having offered Gill free advice on United’s vulnerabilities, Rawlinson was now advising the board as Gill, chairman Roy Gardner, and others tried to decode the intentions of this Florida clan steadily amassing shares.

Rawlinson, who later worked on blockbuster deals like P&O’s £3.9 billion sale to Dubai Ports World and AB InBev’s $100 billion merger with SABMiller, found United small by comparison but outsized in scrutiny.

“You meet some remarkable FTSE 100 leaders,” he recalled, “but that February day, the Glazers didn’t even speak for themselves—bankers handled it. They were selling a debt-laden plan and seeking limited due diligence, yet they barely engaged.”

Small talk revealed their pride in the Tampa Bay Buccaneers’ 2003 Super Bowl win, with the trio eagerly showing off their championship rings—an unusual move for football chairmen, leaving Rawlinson unsure how to respond.

That social stiffness reappeared when they visited Old Trafford later that June, greeted by furious fans chanting “Die Glazer, Die.” The siblings left with armloads of unpaid merchandise—replica kits and souvenirs—picked up from the club shop, their purpose unclear. Unlike traditional owners, they never settled into running United day-to-day, despite two decades of ownership.

Estimating their financial haul from United is tricky, but between the 2012 New York Stock Exchange partial flotation and Sir Jim Ratcliffe’s 28.94 percent purchase in 2023, the six Glazer siblings—legatees of their late father Malcolm—are thought to have netted roughly £1 billion.

Add to that over £1 billion spent on interest payments for the takeover debt, plus dividends, fees, and minor capital repayments, and their wealth has soared. Yet, under their watch, United’s dominance has crumbled through the post-Ferguson years into the Ineos-influenced struggles of 2025.

Back in 2005, the Glazers’ empire rested on a heavily leveraged U.S. shopping mall portfolio, dwarfed by richer NFL families. Today, bolstered by a 2020 Super Bowl win and United’s growth to a £2.4 billion market cap—valued higher by Ratcliffe’s deal—they’re undeniably wealthy, thanks largely to their risky United gamble.

Telegraph Sport spoke to insiders from that era when a little-known Florida family seized a global sporting titan. Malcolm built their fortune on debt; his children scaled it worldwide, buying United with borrowed funds and leveraging its fame to repay it—an investment masterstroke for them, a lingering nightmare for fans.

In late 2004, United was financially robust—£58 million in pre-tax profit, £36 million cash reserves, and just £44 million in debt, buoyed by Beckham’s sale and hosting the Champions League final.

The Nike deal had years to run, Vodafone’s pact was fresh, and wages were a lean 45 percent of £169 million revenue. Chairman Gardner praised the late-2004 signing of Wayne Rooney as a coup. Yet behind the sheen, commercial hiccups—like Nike’s frustration over secondary deals—hinted at cracks, even as new partnerships, like one with Audi, underscored United’s clout.

The Glazers’ arrival flipped that stability. Their June 2005 Vodafone meeting set a tone of brash ambition, unraveling the deal but paving the way for bigger commercial plays—foreshadowing their transformative, contentious two-decade reign.

loading

Loading